A.I. + Human-Assisted Virtual Bookkeeping

Bookkeeping,

Simplified

With HUSL Automated Bookkeeping, our experienced team and purpose-built technology will keep your bookkeeping up-to-date, and provide actionable reports at the touch of a button.

90%

Reduction in Bookkeeper Questions Post Onboarding

-5min

Avg. Time To

Transaction

Categorization

30x

Faster

Financial

Reporting

4.5x

Higher

Accuracy

vs. Traditional Bookkeepers

The World's #1 A.I. Powered Business Expense Tracker

Keeping and organizing a stack of expense receipts for all your purchases is unbearable. HUSL makes this completely automatic with artificial intelligence-based tracking, so there’s no need for you to waste time organizing receipts. Focus on what's important, and let HUSL do the work for you.

$8B

in finances tracked

$300M

in taxes saved

How Bookkeeping with HUSL Works

With HUSL, you’re paired with a professional bookkeeper who can walk you through onboarding and make sure we get you the support your business needs. Our technology works behind the scenes to process and clean your data, and provide you with actionable insights. Say hello to peace of mind.

Connect Your Data

Automate Your Bookkeeping

Grow Your Business

So What Is Virtual

Bookkeeping?

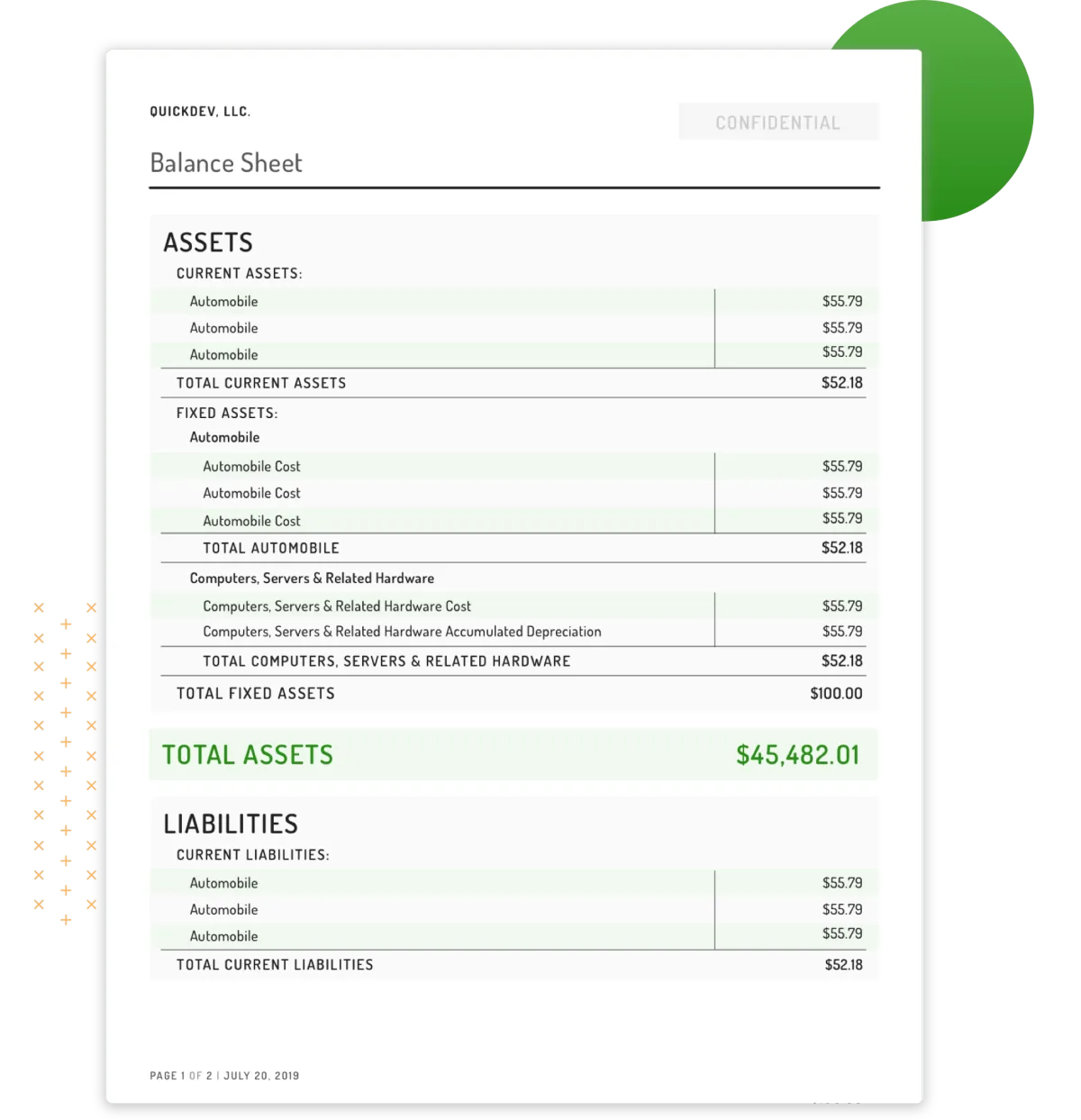

Virtual bookkeeping is a remote bookkeeping service where a professional bookkeeper manages your financial records, transactions, and reporting online, without the need for physical presence.

How does AI play a role in virtual bookkeeping?

In our virtual bookkeeping service, AI takes center stage by providing efficient, accurate, and streamlined financial management. Our advanced AI technology automates tasks like categorizing receipts, reconciling transactions, and financial reporting, effectively reducing the risk of human errors and significantly saving time.

What is the advantage of using AI in bookkeeping?

Using AI in bookkeeping offers many advantages including greater accuracy, faster processing, and valuable insights. It can automate routine tasks, minimize errors, and provide predictive analytics for better decision-making. In combination with a human touch, it offers an unparalleled bookkeeping service.

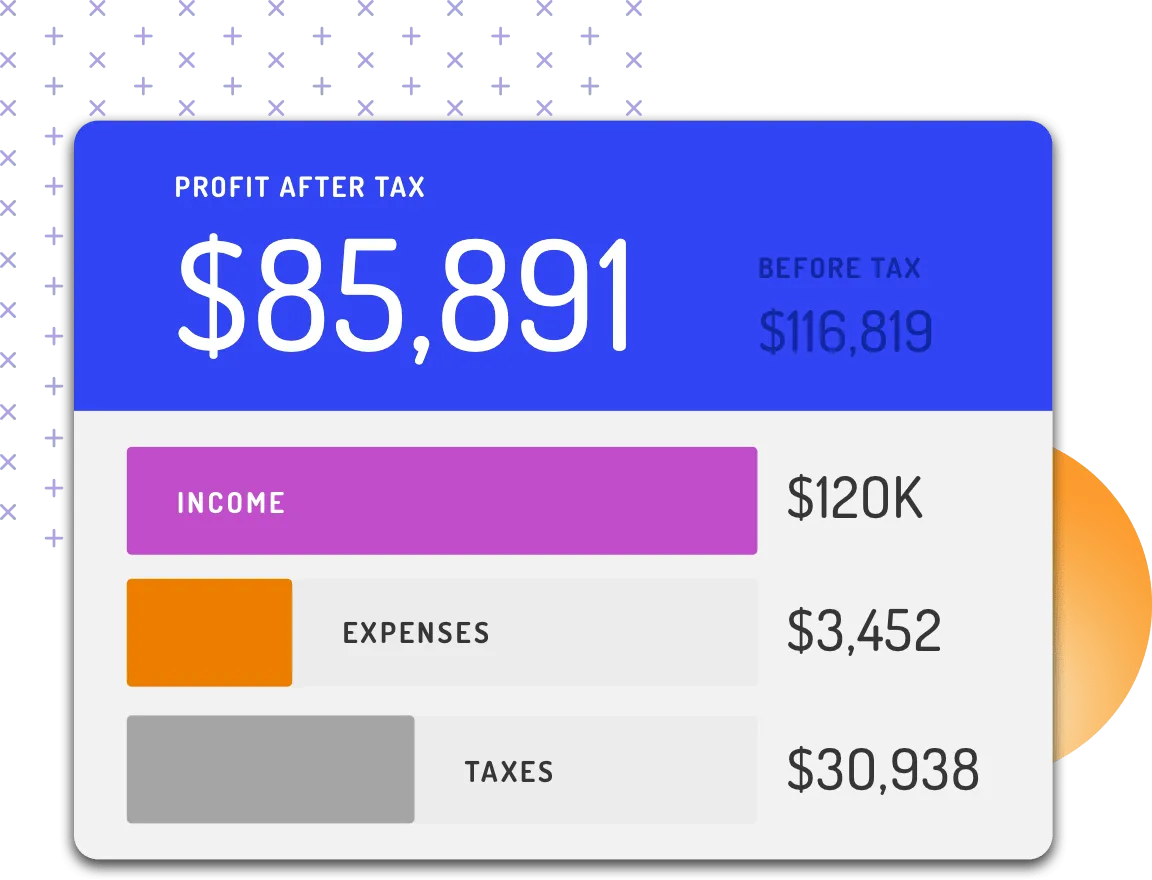

Real-Time Insights & Enhanced Accuracy

By combining the expertise of skilled accountants with artificial intelligence, Virtual Bookkeeping AI automates financial record-keeping and optimizes accounting processes, benefiting a wide range of industries including e-commerce, healthcare, and professional services.

- Ben P.

Husl is awesome! It keeps track of all the financial info you need to know running a business - expenses, income, and mileage. It also does this all automatically.

HUSL A.I. Powered Business Expense Tracking Features For Self-Employed Entrepreneurs

Benefits of Using HUSL Expense Tracker

Save Time: No more need to keep a box of cluttered receipts. Just work on your business.

Save Money: A.I. Automatically capture all of your deductions and never miss a deduction.

Save Organized: You're always up to date with tax reports that make tax filing a breeze and expense reports that make reimbursement painless.

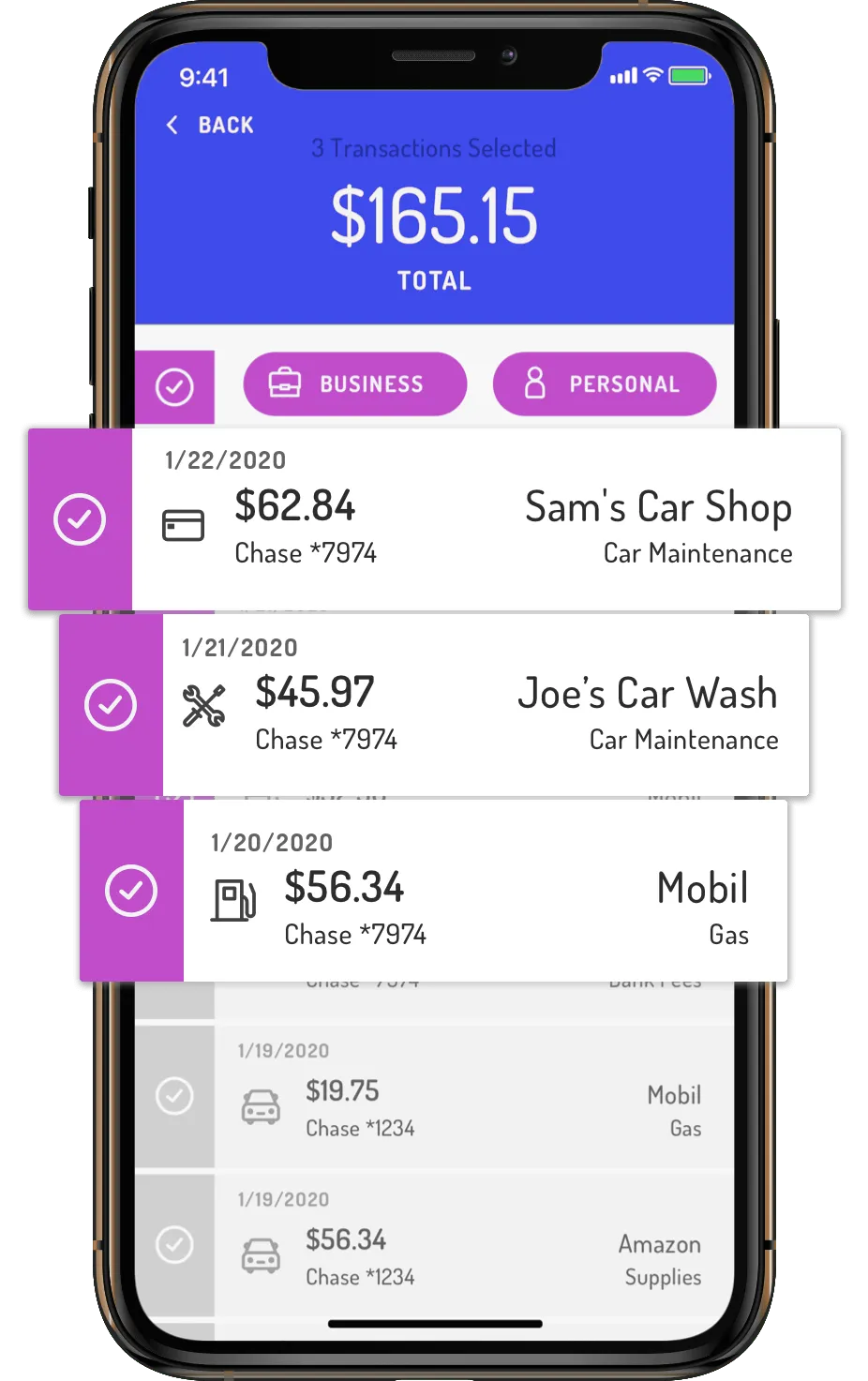

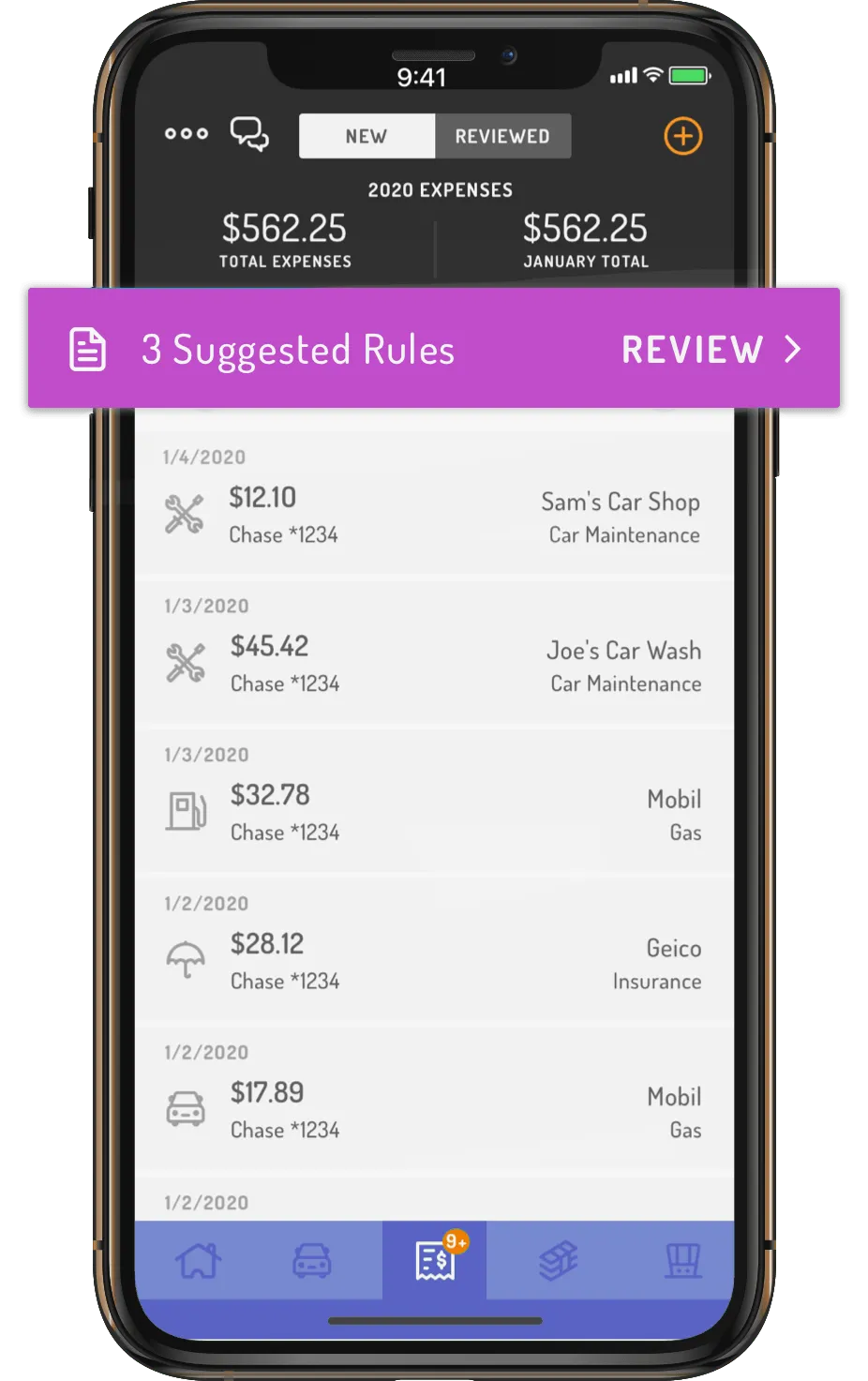

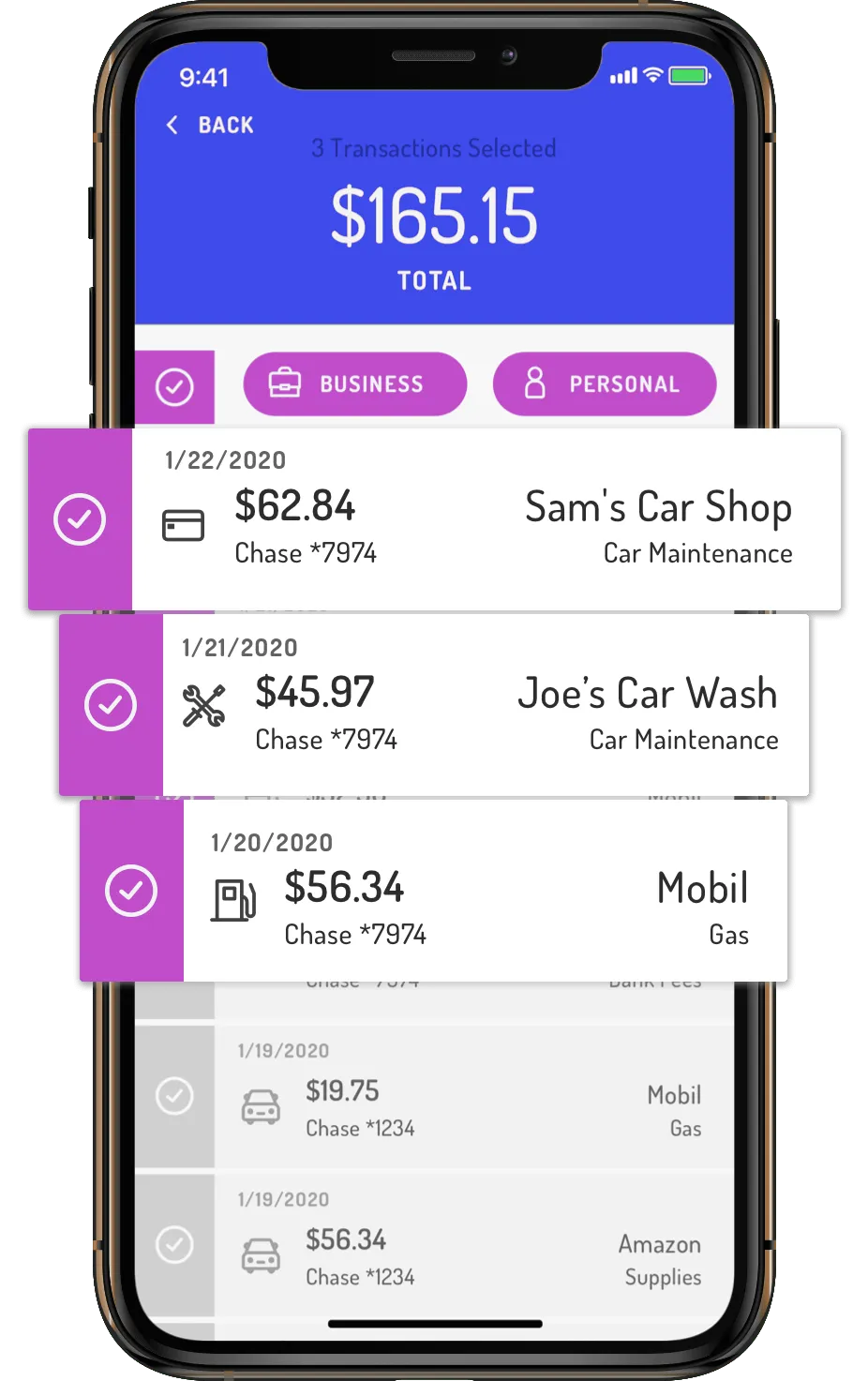

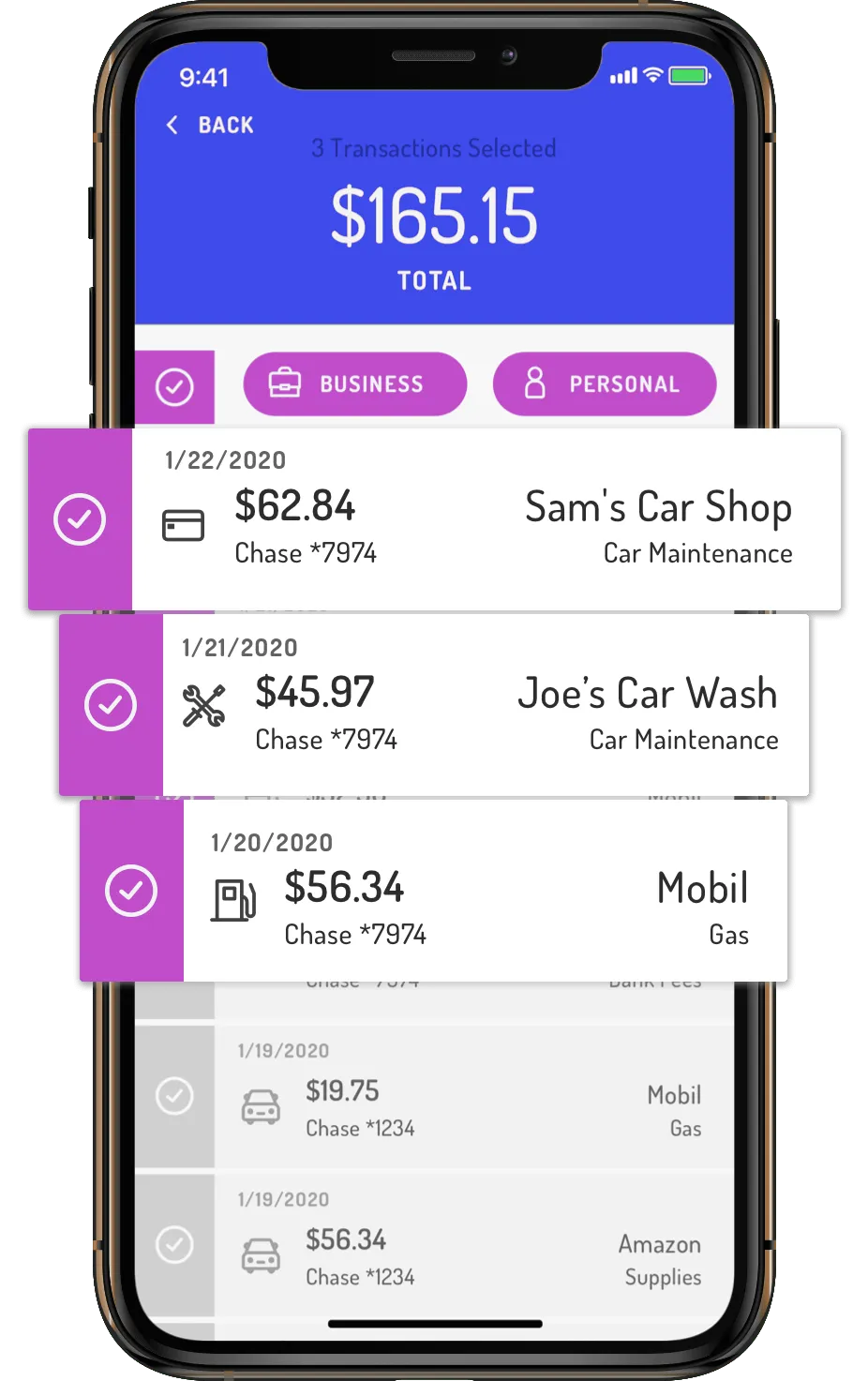

Automatically tracks your expenses

A.I. scans every expense & finds deductions. HUSL's A.I. analyzes your expenses, identifying every tax write-off based on 200+ deduction categories.

Auto-tags repeat expenses for you. A.I. never lets you forget!

A.I. notifies you whenever a deduction occurs and it doesn't forget. This gets you guaranteed maximum savings.

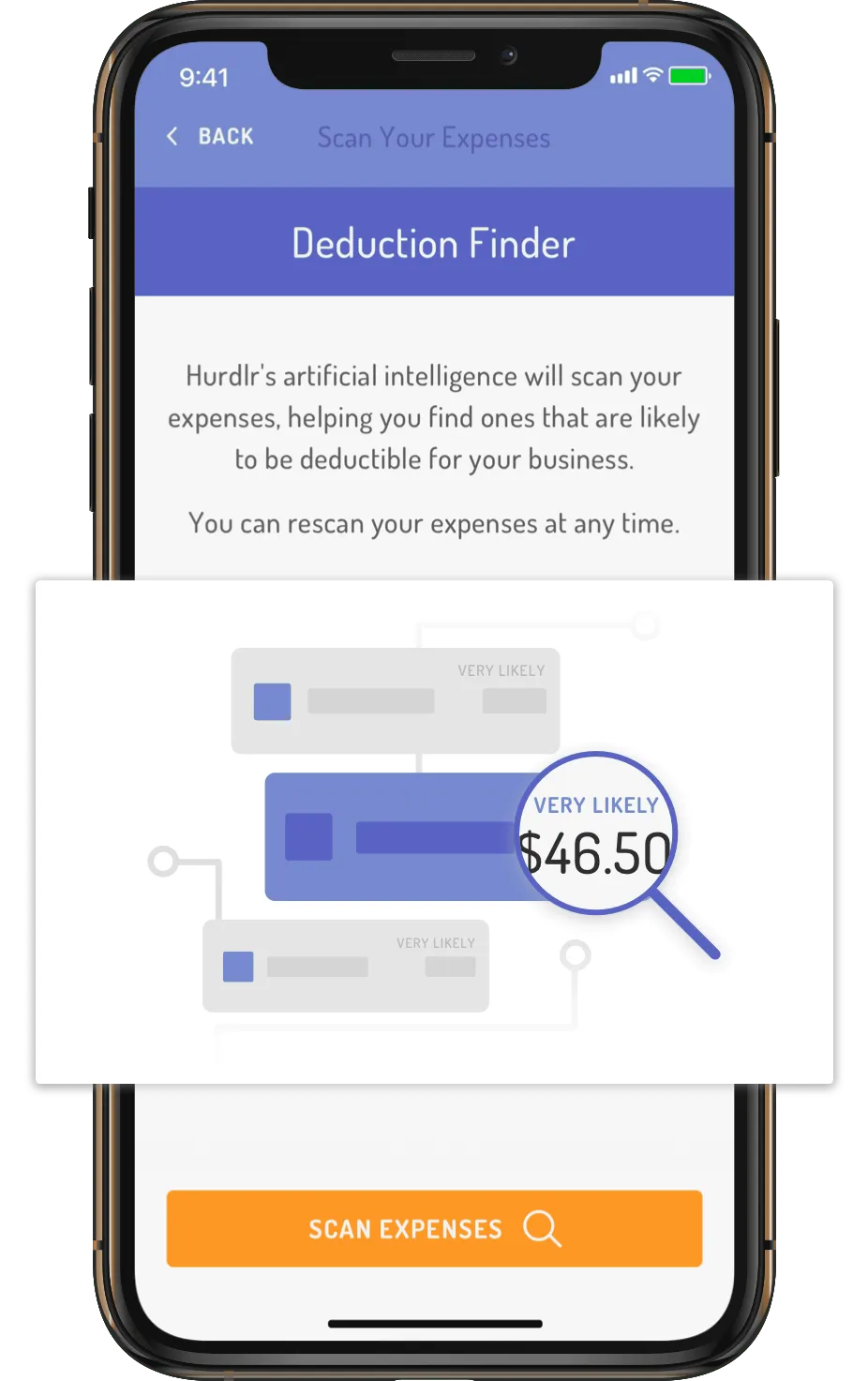

Machine learning quickly finds expenses that you can deduct

HUSL's A.I. powered Deduction Finder helps you instantly find more deductions, specifically for your business.

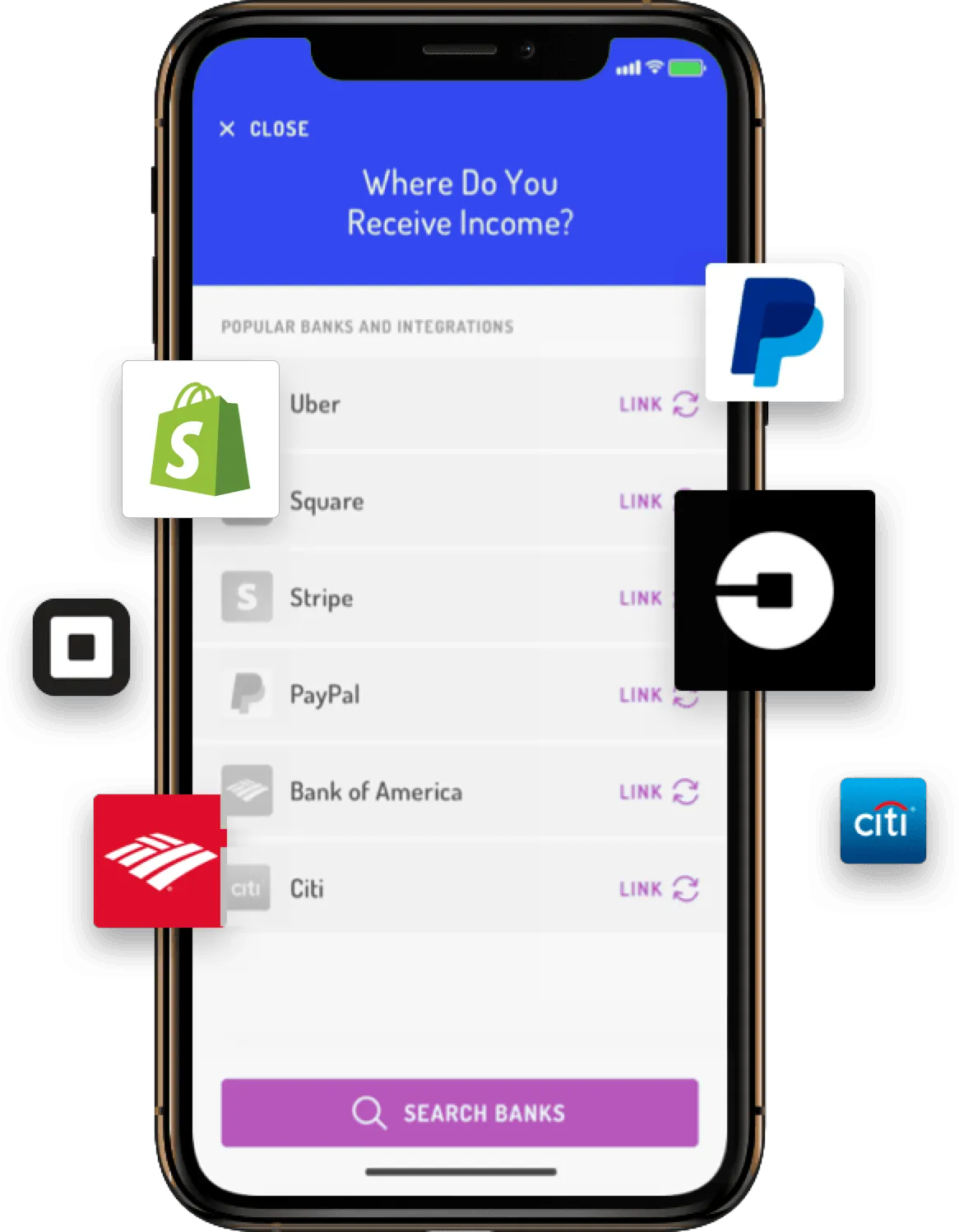

Links with over 10K banks & integrations

Streamline your expense tracking. Simply connect all your expense accounts & HUSL eliminates 95% of your work.

Not Sure About an Expense?

A.I. & CPAs work together to get you maximum savings.

Mileage Tracking Features

A Mileage Tracker For Self-Employed Entrepreneurs Like You

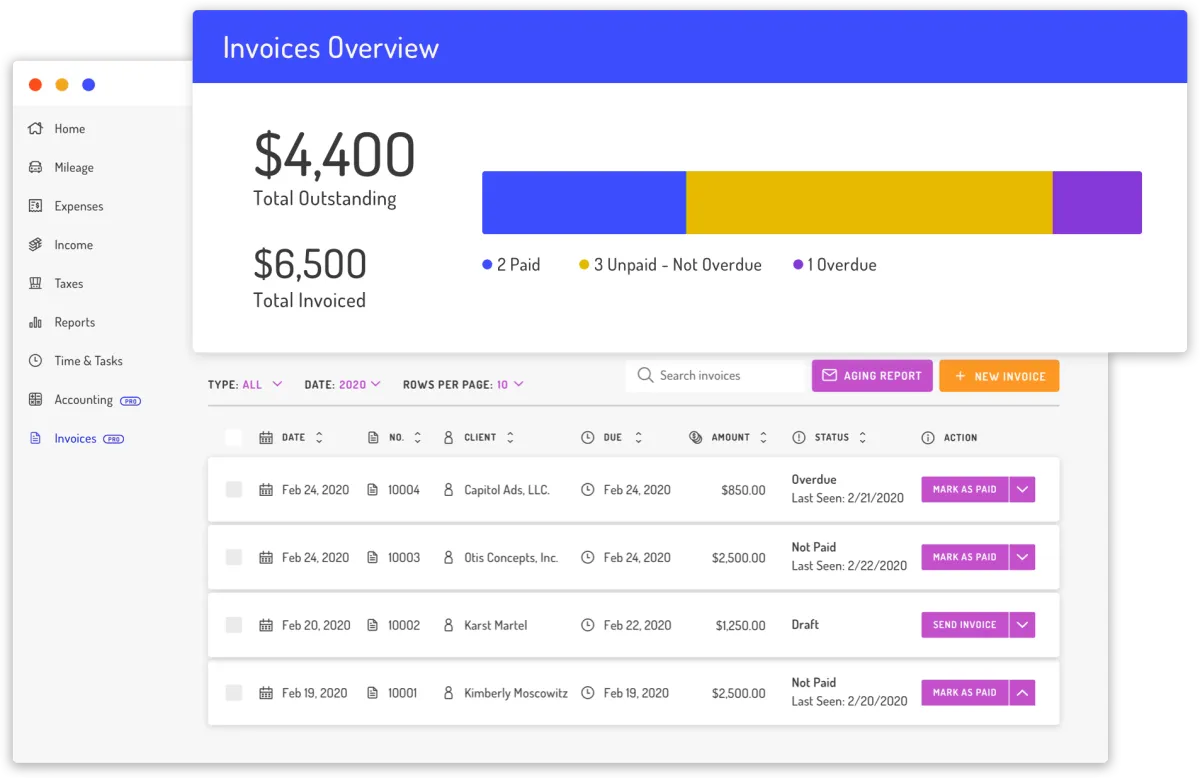

Fast and easy invoicing with automated payments, designed for small business owners and contractors like you who don’t have staff to do this. Never accepted credit cards? With HUSL, it’s a breeze.

HUSL automates your invoicing, credit card payments and collections, so you can spend more time doing what you love.

HUSL Invoicing Features

The Best Invoicing Software for You

Fast and easy invoicing with automated payments, designed for small business owners and contractors like you who don’t have staff to do this. Never accepted credit cards? With HUSL, it’s a breeze.

HUSL automates your invoicing, credit card payments and collections, so you can spend more time doing what you love.

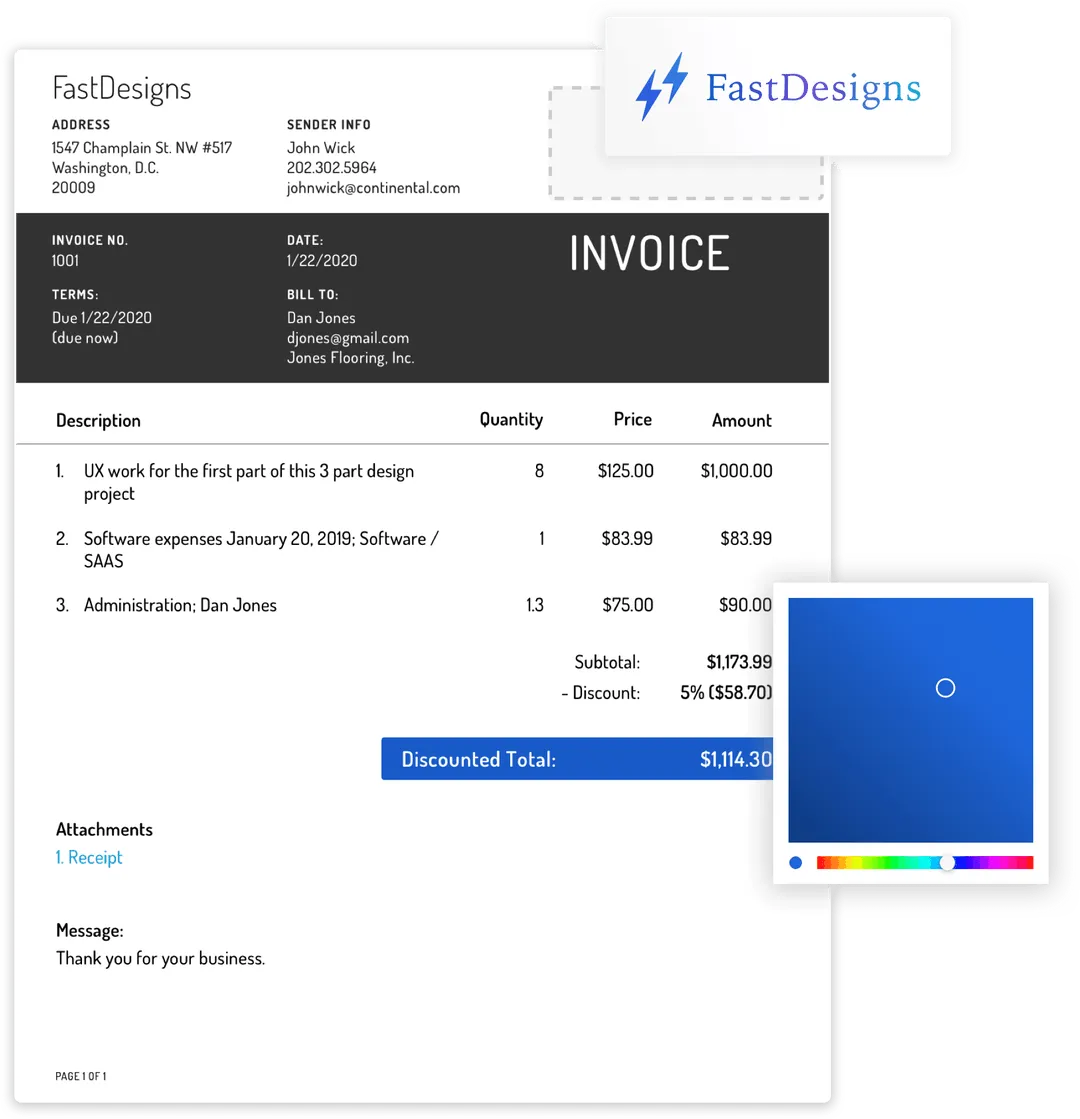

Fully Customizable Professional Invoices

Use your company’s brand identity for all your invoices

Easily Accept Credit Card Payments

Easy to set up and get paid quickly

Reimbursable Expenses, using a linked Credit Card

Never manually enter expenses again

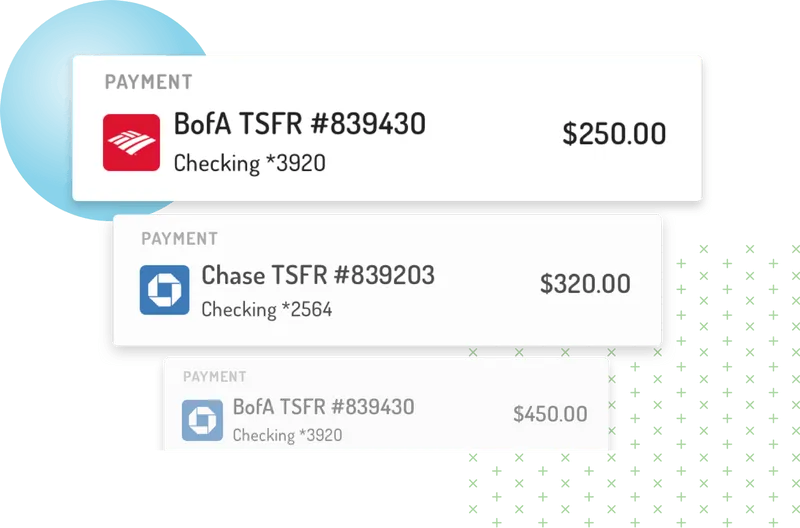

Automatic Payment Reconciliation

Bank deposits are automatically matched up with your invoices

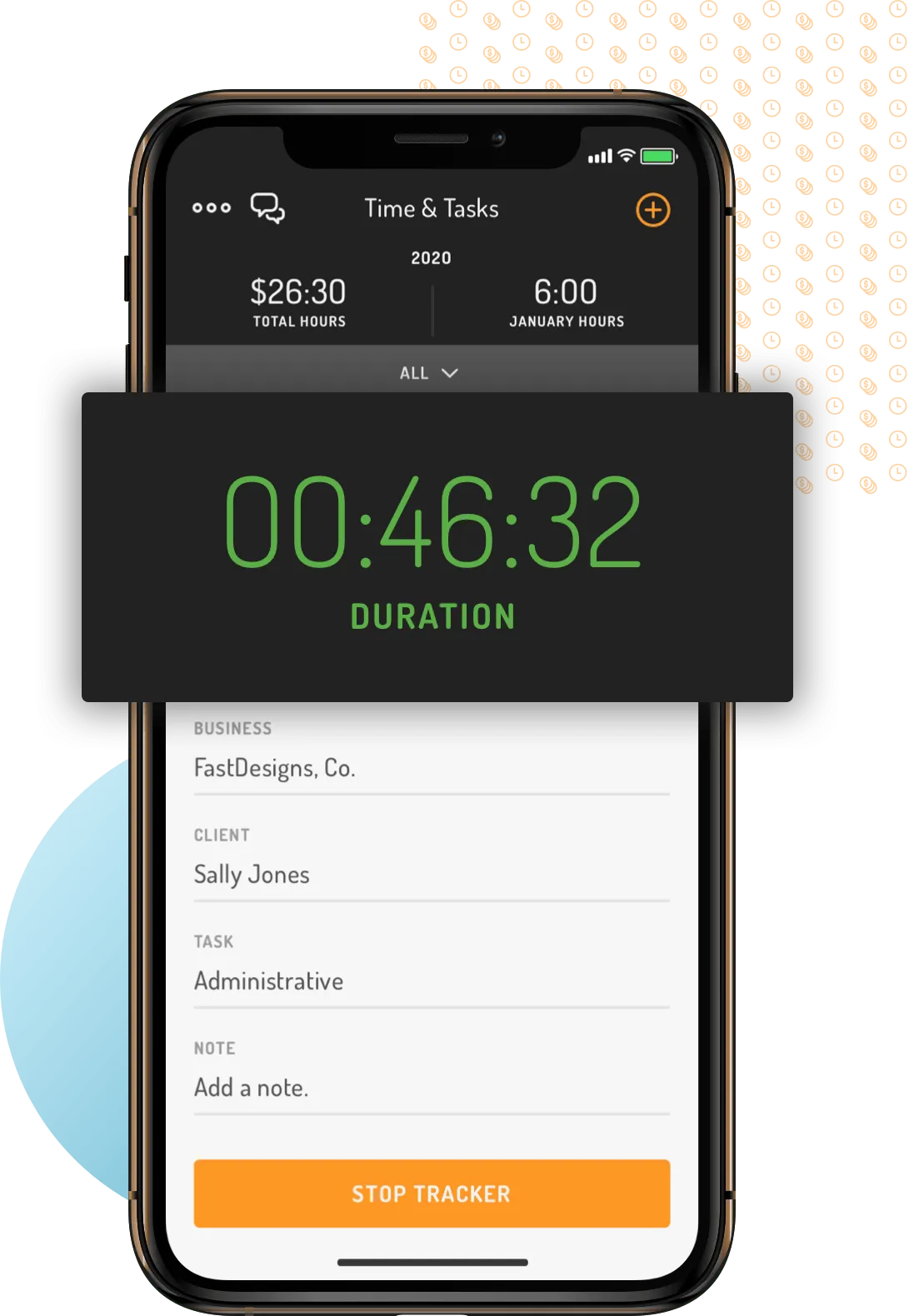

Track Time

Easily track your time for any of your tasks

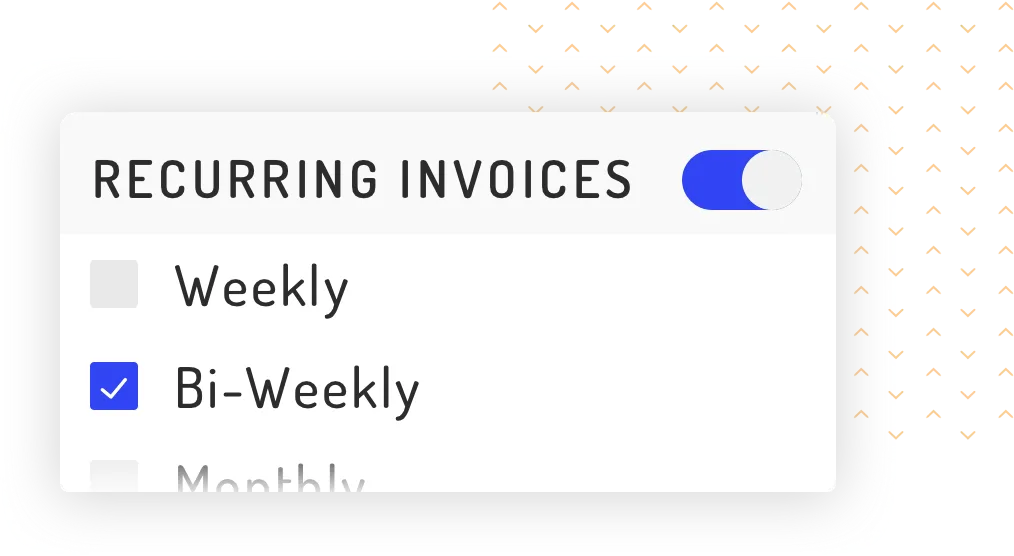

Create Recurring Invoices

Save time creating invoices for any client

More than just invoices, connects all the dots

Know your profitability and income taxes in real-time estimates, and more

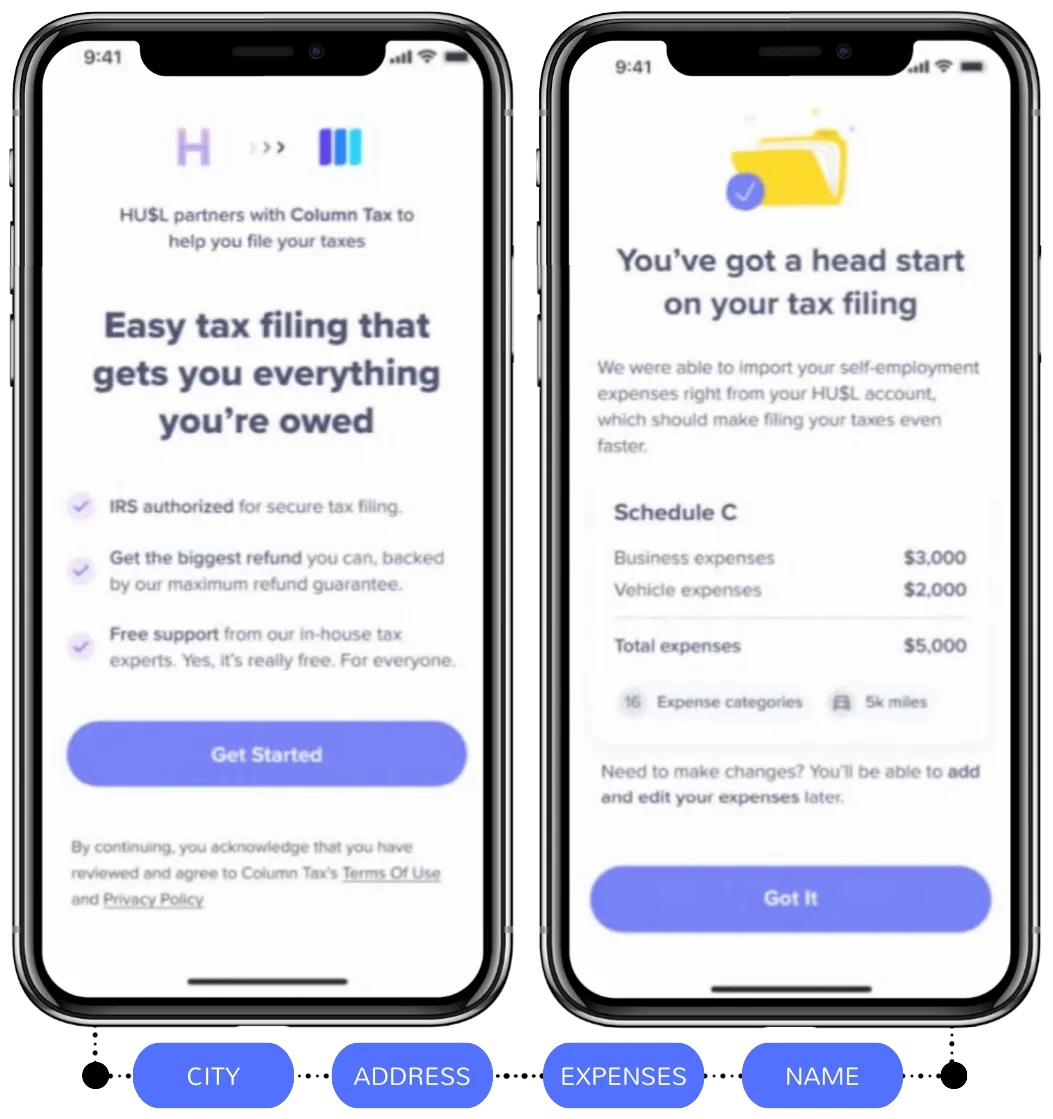

HUSL Embedded Tax Filing Features

Awarded best tax product of the year

Tax Filing Just Got Way Easier

20x faster. A.I. eliminates 95% of your work

Maximum refund.

Save up to $3,700 extra in taxes

Full audit insurance. CPAs got your back

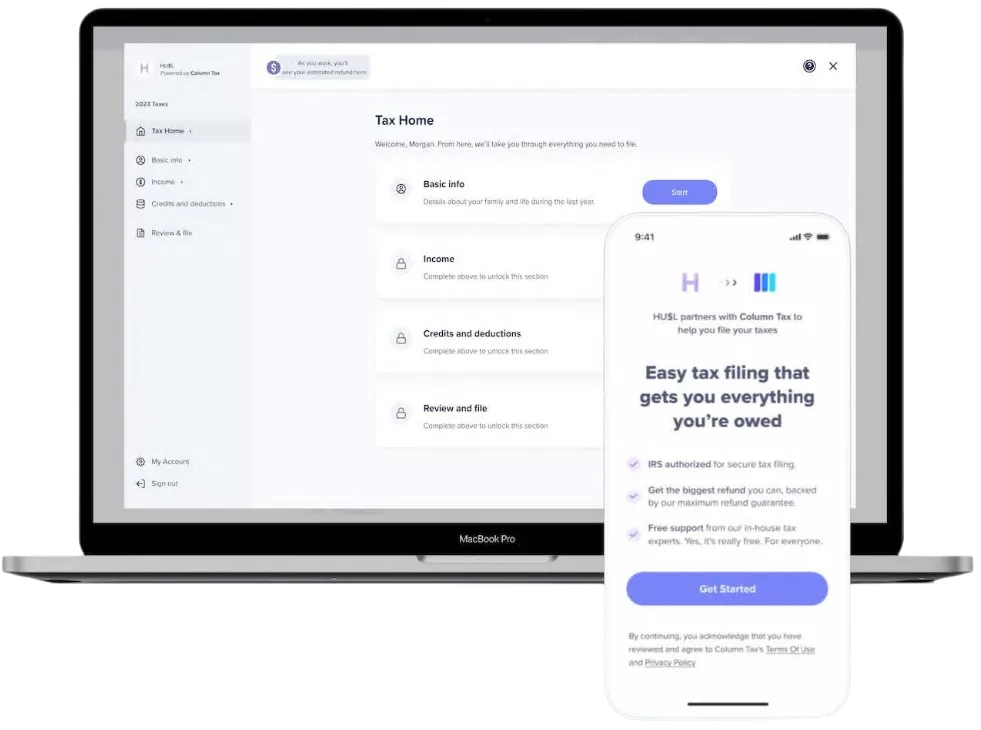

World’s First All-In-One, A.I. and Tax Professional Tax Filing Service

For freelancers, self-employed, business owners, 1099 & W-2 workers

IRS Authorized e-File Provider

Column Tax is the first ever IRS authorized API-first tax filing product

The only all-in-one, end-to-end embedded tax platform

A.I. finds every tax deduction - 20x faster

CPAs and Tax Pros file your taxes from start to finish - 5x cheaper

100% Max Refund Guarantee, Accuracy Guarantee, and Audit Assistance

Jumpstart Filing with HUSL. Starting with Pre-Filling.

HUSL A.I. analyzes your expenses, identifying every tax write-off based on 200+ deduction categories.

With HUSL, users don't have to re-type all of their data.

Pre-filling includes personal & business information right from the tax return

Upload your tax documents in 2 minutes

The team of CPA's and Tax Pros prepare your federal and state tax returns for your review and e-sign

Supercharged Tax Filing with HUSL + Column Tax

The Fastest Way to File

With HUSL, users don't have to re-type all of their data. Make tax filing feel like magic by bringing in all the data

at the start.

Maximum refund. Guaranteed

Every return comes with a maximum refund guaranteed. Taxpayers can file with peace of mind knowing they are

getting their largest refund.

Products that are safe and secure

Bank-grade encryption and the highest compliance standards mean user data is always secure.

Goodbye spreadsheets Hello A.I.

A.I. scans for all possible tax deductions. Simply connect all your expense accounts & HUSL eliminates 95% of your work.

When customers see how the data you’ve tracked for them throughout the year gets pre-filled into their tax return, you’ll not just delight them at tax time — you’re helping them see the payoff of working with you year-round and year after year.

The Column Tax Difference

By pulling in data that's already in your platform, customers avoid guesswork and deliver an accurate estimate with the most up-to-date information.

World-class tax CPAs and Tax Professionals from start to refund

Column tax experts is the best of the best, including team members from heavy hitters of the industry like Intuit, TaxAct, H&R Block, Cash App, Wolters Kluwer, and others.

Nick P.

"It’s really easy to link accounts and to show profit/expenses. Auto tagging is a great feature to help repeated transactions! Great job!"

Ben B.

"HUSL is awesome! It keeps track of all the financial info you need to know running a business - expenses, income, and mileage. It also does this all automatically."

Kyle J.

"This software not only tracks your mileage, it also tracks all of your expenses automatically. This is the reason I chose HUSL over the other software."

Virtual Bookkeeping Solutions

For Your Business

Don't let tedious bookkeeping tasks hold you back. Embrace the power of AI and automation to ensures that your books are consistently up-to-date, accurate, and organized, freeing you from mundane bookkeeping tasks and letting you focus on what you do best - running your business.

Software Only

$99 mo.

a one-time $50 setup fee

Suitable for solopreneurs who want to handle their own bookkeeping

(Do-it-yourself)

A.I. scans every expense & finds deductions

A.I. notifies you whenever a deduction occurs

Quarterly tax calculator

Starting at

$159 mo.

a one-time $50 setup fee

Suitable for small businesses or solopreneurs with a low volume of monthly transactions

(up to 100 transactions/month)

US-based Dedicated Virtual Bookkeeper

Monthly AI Bookkeeping Services (including automated data entry, expense categorization, and invoicing)

Monthly Financial Reports and Reconciliations

Quarterly tax calculator

Annual 1040 tax filing

Ask CPA/Zoom call with CPA

Starting at

$299 mo.

a one-time $50 setup fee

Suitable for medium-sized

businesses with a moderate volume of monthly transactions

(up to 300 transactions/month)]

US-based Dedicated Virtual Bookkeeper

Weekly AI Bookkeeping Services (including automated data entry, expense categorization, and invoicing)

Monthly Financial Reports and Reconciliations

Quarterly tax calculator

Annual 1040 tax filing

Ask CPA/Zoom call with CPA